Love, as they say, is a many-splendoured thing. It’s a force that defies logic, a feeling that transcends borders, time, and even sometimes reason. But when it comes to marriage, a little bit of logic can go a long way—especially when it comes to financial compatibility. While you may have been swept off your feet by the person of your dreams, it’s essential to keep in mind that love and money often go hand in hand, whether you like it or not. The business of love isn’t just about shared dreams and common values; it’s also about making sure that your finances align before you walk down the aisle.

Think of marriage as running a business. You’re not just combining two lives; you’re also merging your financial portfolios, goals, and priorities. Just like a successful business partnership needs aligned values and strategies, so does a successful marriage. From joint savings accounts to investing in shared dreams, navigating the financial waters of marriage requires transparency, planning, and a bit of compromise.

The silent partner in every marriage

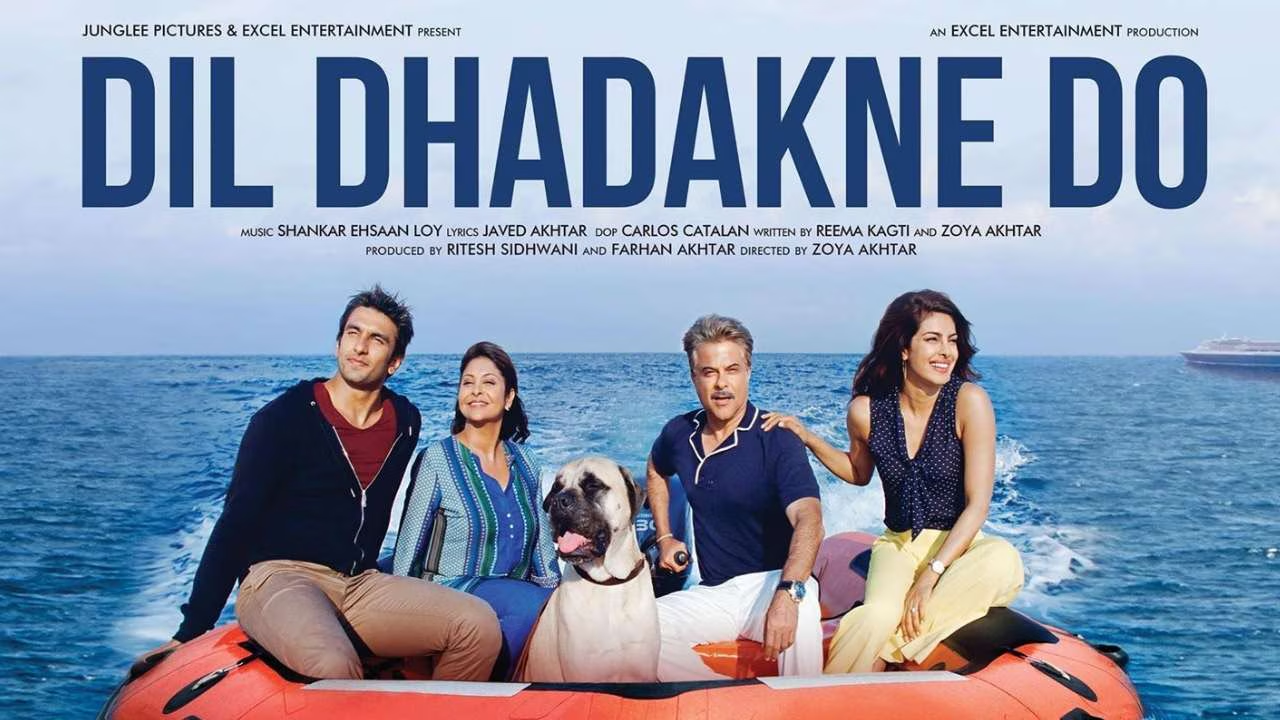

Money is like the unseen character in every Bollywood romance, often lurking in the background until it finally steps into the spotlight and causes a bit of drama. It’s there, silently influencing decisions, whether it’s how a couple chooses to spend their vacation or how they handle a sudden financial emergency. Take the example of Dil Dhadakne Do (2015), where the Mehras, a wealthy family, are shown navigating not just emotional complexities, but also the financial pressures of maintaining their status. Despite all the glamour, the underlying theme is clear: Money impacts relationships. In the movie, the financial status of each character influences their behaviour, their choices, and their approach to love.

In real life, financial stress can be a major source of conflict in marriages. Studies have shown that money problems are among the top reasons for divorce. A couple who doesn’t share similar financial habits may find themselves at odds, whether it’s arguing over saving for the future or spending on an impulse buy. In fact, it’s not just about agreeing on how to budget—it’s about understanding the emotional and psychological components behind money management. The trick lies in bridging these differences with mutual respect and understanding.

Understanding financial habits

Understanding your partner’s financial habits goes beyond knowing how much they earn or how much they owe. It’s about delving into their money mindset. Are they more like Naina Talwar from Yeh Jawaani Hai Deewani (2013), who meticulously plans for the future, or are they more carefree, like Bunny, who lives in the moment? One’s a saver, the other a spender. While opposites can complement each other, an imbalance here can lead to tension.

Even Bollywood celebrities face the financial compatibility dilemma. Actors Virat Kohli and Anushka Sharma, who are one of the most talked-about celebrity couples in India. While both are incredibly successful in their respective careers, their financial habits and attitudes toward money were quite different early in their relationship. Virat, being a cricketer, has a deep connection with sports sponsorships, investments, and the financial rigours that come with being a high-profile athlete. Anushka, on the other hand, is a businesswoman with a clothing line, and her financial perspective comes from a very entrepreneurial standpoint. Despite these differences, they’ve managed to find a balance. The key? Open communication and understanding of the other’s perspective.

The best approach here is to have open discussions about your financial philosophy. It’s important to align your money habits and understand the emotional triggers that accompany them so that you can work together rather than clash.

Conversations you need to have

Before jumping into marriage, there are some essential conversations you need to have about money. As much as we all like to think that love will conquer all, there are a few practical aspects of life that need attention. Here are a few things you should discuss:

Income and expenses

Be transparent about how much you both earn, how much you spend, and any existing debts. Having these open conversations can avoid misunderstandings later.

Budgeting

Do you prefer to stick to a strict budget, or are you okay with spontaneous spending? This ties into your overall financial strategy. Do you believe in saving for a rainy day, or are you more of a “live in the moment” kind of person?

Financial goals

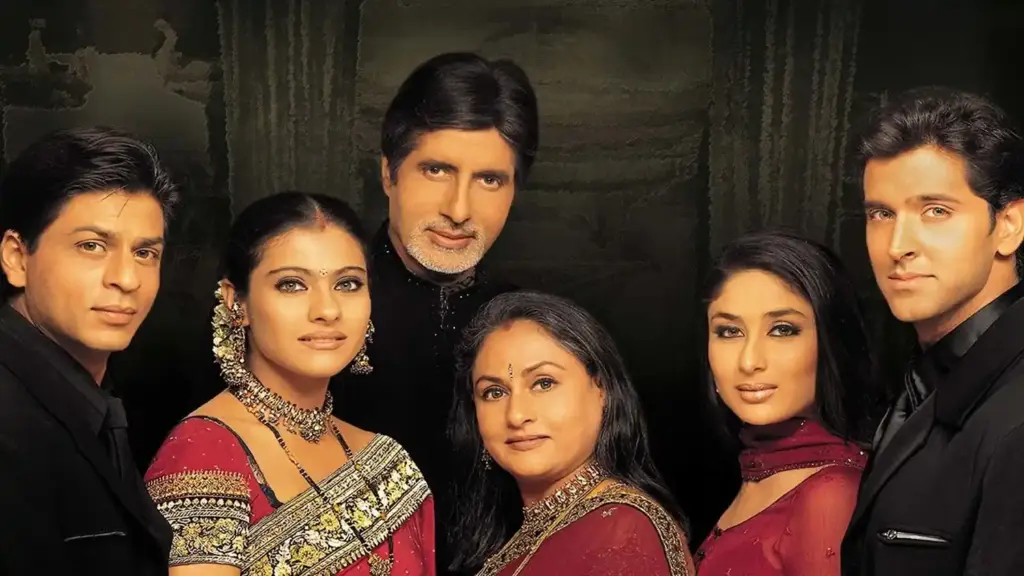

The ultimate goal is to align your dreams. Do you both want to save for a house, travel the world, or start a family? Financial compatibility doesn’t just stop at how you manage your day-to-day expenses but extends to planning for the long term. Think about Shah Rukh Khan and Kajol’s characters in Kabhi Khushi Kabhie Gham, who go through various financial trials together, but their shared commitment to each other’s dreams helps them overcome the hurdles.

Investing and savings

Will you be on the same page when it comes to investing and saving for the future? Whether it’s retirement, buying a house, or planning for children’s education, understanding each other’s long-term investment strategies will help you build a financial foundation.

Transparency and trust: The cornerstones of financial compatibility

Trust is the bedrock of any relationship, and when it comes to finances, transparency is its foundation. Going back, Dil Dhadakne Do explores the dynamics of family and trust, where the Mehras, despite their wealth, have secrets that affect their relationships. Financial secrets can do more harm than good in a marriage. If one partner hides debt or overspends, it can breed mistrust, leaving the other feeling blindsided.

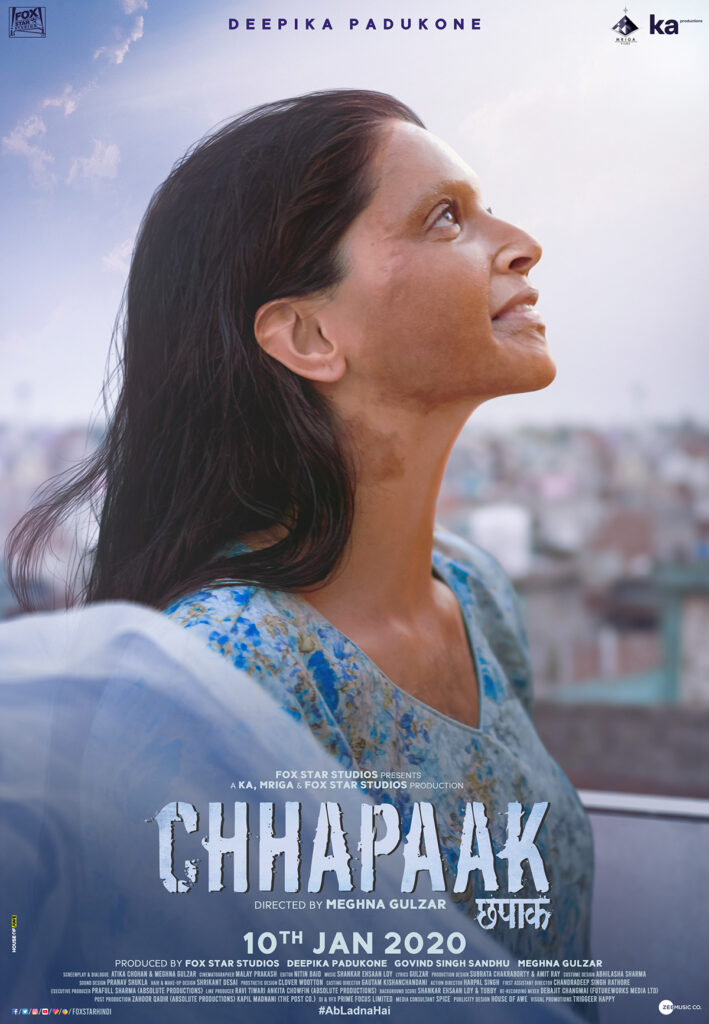

Even Bollywood celebrities face the financial compatibility dilemma. Take the example of Deepika Padukone and Ranveer Singh, one of the most adored couples in Bollywood. Despite their shared success and fame, they have always emphasised their individuality when it comes to finances. For instance, when Deepika produced her movie Chhapaak (2020), she was asked by a journalist whether the investment in the film came from their joint finances. Deepika clarified that the money was not from their joint finances but from her independent earnings and investments. This instance showcases a crucial aspect of financial compatibility in relationships: respecting each other’s financial independence while building a future together. It’s an example of how couples, even those who share everything else, should maintain a level of financial independence that allows them to pursue their own ambitions.

Love and money: A beautiful balance

In the grand scheme of things, love and money don’t have to be enemies. In fact, they can complement each other beautifully. Financial compatibility, while crucial, isn’t about having the same salary or the same attitude towards money—it’s about working together to align your goals, values, and dreams.

So, the next time you’re thinking about love, remember: It’s not just about hearts and flowers. It’s about making sure your financial future is as bright as your shared one. After all, even in the movies, it’s the couple that plans together, stays together.